Budget 2023/2024

On March 21, 2023, Berwick approved the 2023/24 Operating Budget and the 5-Year Capital Investment Plan.

The approved 2023/24 Operating Budget may be found here

The approved 2023/24 5-Year Capital Investment Plan may be found here

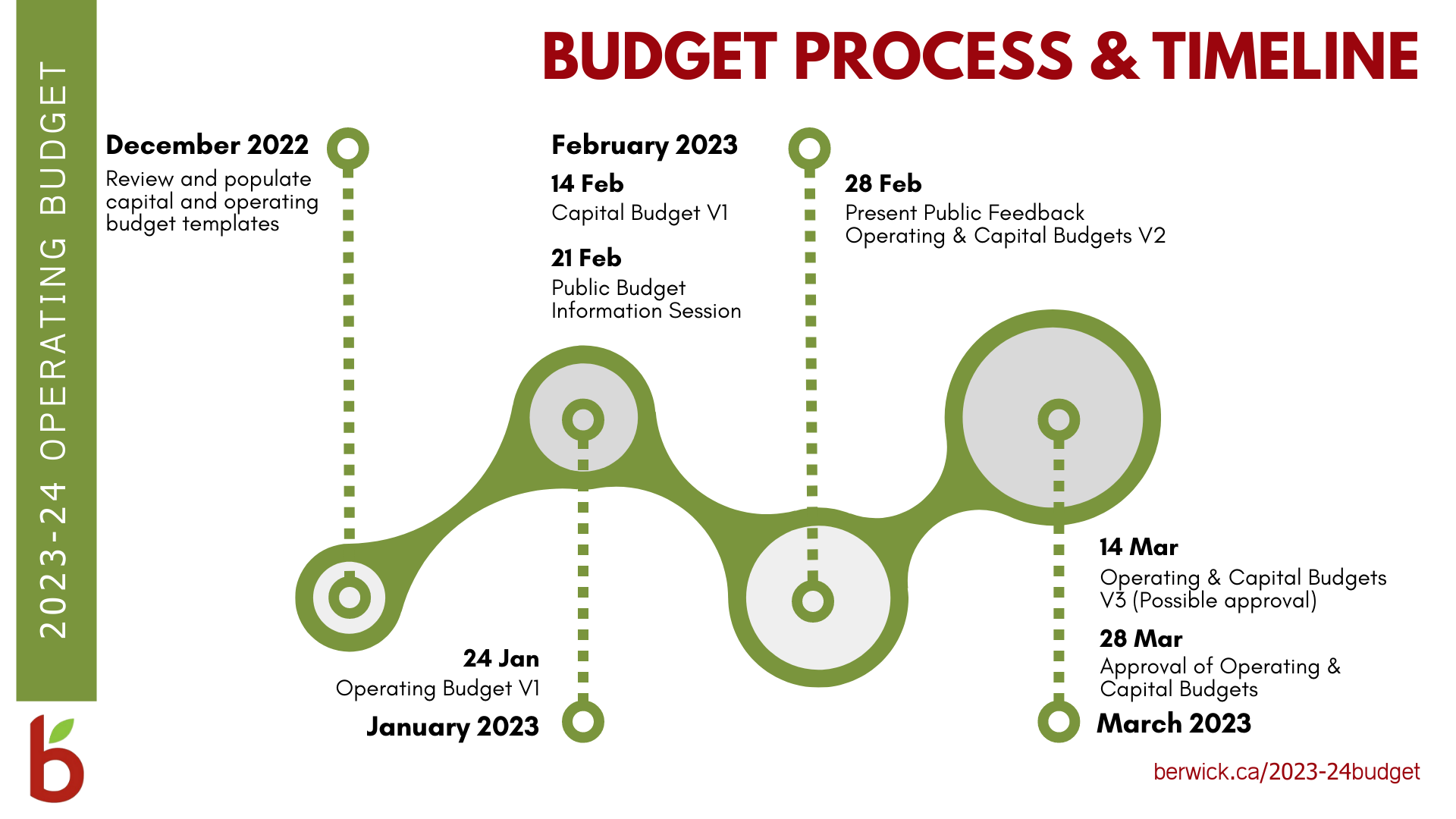

Berwick began the 2023-24 budget process in December 2022, working through preliminary budget information, and engaging all departments in the process to best understand the needs and requirements of operations.

Every Committee of the Whole and Council meeting from January 24 to March 28 will be an opportunity for Council to discuss, seek clarification, and provide direction to staff to move the operating and capital budgets forward for approval by March 28, 2023.

Until the budget is officially approved by Council, the highlights identified below are subject to change based on Council discussion, direction, and changes to assumptions.

As a reminder, property assessments are set by Property Services Corporation (PVSC). A copy of their presentation to the Council regarding the 2023 Tax Roll can be found in the January 10, Town Council Agenda Package. Please contact PVSC if you have any questions about your assessment. Notices were sent to property owners on January 9, 2023. The appeal deadline is February 9, 2023.

This page will be updated 2-3 days following the discussion of the budget between now and March 28, 2023. Use the links below to navigate to the most recent information.

Jan. 24, 2023 - Version 1 of the 2023-24 Operating Budget (Special Town Council Meeting)

Feb. 14, 2023 - Version 1 of the 2023-24 Capital Investment Plan (Town Council Meeting)

Feb. 16, 2023 - Budget Engagement Session

The 2023-24 Budget Process is outlined below:

Version 1 of 2023/24 Operating Budget was presented to Council on January 24.

Version 1 Highlights

Revenue

- Tax Revenue increased by $472,000 of 13%, assuming a 0% change in the tax rates.

- Sale of Service increased by $40,000 or 8%, due to review of administration fees recovered from the Berwick Electric Commission (BEC) and Town sewer. Did you know? Existing Town Staff spend 2.2 FTE (Full-Time Equivalents) hours supporting BEC operations. This is recovered through an Administrative Fee.

- Federal, Provincial & Other Grants increased by $7,000 or 2%, due to the Community Development Department’s success securing summer labour grants.

- Other Revenue increased by $66,000 or 35%, due to an increase to revenue from the Berwick Fitness Centre, largely due to an increase in memberships, program offerings, and personal training.

- Other Transfers decreased by -$55,000 or -20%. In 2022/23, the Town budgeted to transfer $49,000 from Operating Reserves to balance the budget. In Version 1, a transfer from Operating Reserves is not required.

Expenditures

- General Government increased by $98,000 or 5%, significant changes include:

- Re-allocating Executive Coordinator expense 100% to General Government, an increase of $27,000.

- Significant investments to IT Hardware and Software to support key improvements to operations, an increase of $57,000 ($19,000 will be covered by the Safe Restart Funding).

- Mandatory partner contributions increased by $15,000.

- Grants to Organizations increased by $7,000.

- • Protective Services decreased by -$14,000 or -1%. The main driver of the decrease was a reallocation of Building and Fire Services from Bylaw to Planning and Development.

- • Planning & Development increased by $56,000 or 46%, changes include:

- Reallocation of Building and fire Services from Bylaw of $33,000.

- Contract to complete the Municipal Planning Strategy Review of $12,500.

- Increase to GIS of $10,000.

- • Community Development increased by $72,000 or 11%, changes include:

- New FTE, Communications & Executive Coordinator, beginning in August for $35,000.

- Program salary and wages have increased by $30,000, with a portion of the increase related to CPI increases and the balance coming from the addition of a Program Leader for the After-School Program.

- Reduction of misc. expenses by $3,000.

- Addition of $10,000 to support Centennial Celebrations.

- • Public Works increased by $245,000 or 24%, significant changes include:

- Two new FTE’s, a Heavy Equipment Operator for $80,000 and a Director of Public Works who will work with the current Director of Public Works (proposed to be Manager) to begin succession planning. This is an increase of $96,000 (75% of the costs).

- Operating Supplies for Winter maintenance has increased by $20,000 to reflect historical, actual trends.

- Storm Sewer maintenance increased by $15,000, and Traffic services includes an additional $15,000 to cover centre line painting and traffic control for line painting.

- Repairs and maintenance increased by $10,000 to ensure proper service and maintenance is completed given our older fleet.

- Utilities are projected to increase by $9,000.

- • Environmental Health (Sewer) increased by $82,000 or 19% changes include:

- The remaining 25% of the new Director of Public Works.

- Utilities increased by $25,000 and repairs and maintenance by $22,000.

- Increase to an administrative fee of $13,000.

Staff also proposed staffing level changes that have been included in Version 1. A total of three new FTE (Full-Time Equivalents) is proposed to prepare for two retirements within the next two years.

Documents from the meeting include:

• January 24, Committee of the Whole Agenda Package where V1 of the operating budget can be found.

• 2023/24 Operating Budget Presentation

On February 14, 2023, at Town Council, staff presented Version 1 of the 5-Year Capital Investment Plan (CIP), prepared with priories as identified by the current CIP and management, combined with the valuable information included in the recently received Asset Management Plan.

Council also received information regarding Tax Rate scenarios.

Documents from the meeting include:

• February 14, Town Council Agenda Package, where V1 of the capital investment plan can be found, as well as the information report regarding tax rate scenarios.

Feb. 21 Budget Engagement Session

On February 21, 2023, the Town held a Budget Engagement Session that included a 10-minute overview presentation of V1 of the Operating and Capital Budgets, as well as Priorities for 2023/24. The remainder of the evening involved discussions with staff and council regarding printed material displayed around the room. Feedback from the event will be shared with Council on February 28.

Documents from the meeting:

• Feb. 21 Budget Engagement Session Information

Feb. 28 Committee of the Whole

On February 28, 2023, at Committee of the Whole, staff presented version 2 of the operating budget, version 2 of the 5-Year Capital Investment Plan, as well as scenarios pertaining to Reserve and Debt Service Financial Condition Indicators.

Version 2 Highlights

- Until the budget is officially approved by Council, the highlights identified below are subject to change based on Council discussion, direction and changes to assumptions.

Revenue

- Deed Transfer tax reduced by $40,000 to reflect cooling of the real estate market

- Sewer revenue increased by $13,000 based on 2023/24 operational budget requirements

- Planning revenue increased by $2,000 to reflect anticipated development activity.

Expenses

- Insurance increase of $20,000, primarily due to inflation of property and casualty insurance.

- Educational contribution was confirmed at $583,099, an increase of 3.3%.

- Compensation increases of $71,000 relating to the third party compensation review, received in draft form.

- Partner contributions to VWRM are expected to increase by $21,000, Fire Services Operating Grant from MOK expected to decrease by $22,000 and KTA expected to increase by $18,035.

- Miscellaneous expense reductions of $27,000 included.

- Addition of Storm Water Management Plan with an expense of $10,000.

Documents from the meeting include:

Mar. 21 Town Council Meeting

On March 21, 2023, at Town Council, staff presented version 3 of the operating budget and version 3 of the 5-Year Capital Investment Plan.

Version 3 Highlights

- Until the budget is officially approved by Council, the highlights identified below are subject to change based on Council discussion, direction, and changes to assumptions.

Revenue

- Slight increase to funding utilized from Safe Restart funds for two additional laptops.

- AREA's dividend budget was reduced by $38,000 because of the recent financial forecast.

- Funding of VWRM equipment contribution from previous years’ budgeted contribution which was not required (surplus 2022/23)

Expenses

- IMSA working group budget (KTA and VWRM) increase to $8,142 based on the agreed schedule.

- KTA budget increased by $15,849 for core operating, core capital, and replenishment of reserves.

- A CPI rate of 6% is applied to non-union salaries and council honorariums; a rate of 7.5% is applied to unionized employees.

- PVSC invoice received reducing the budget by $1,800.

- Miscellaneous adjustments include reducing facilities maintenance by $4,000 and sewer maintenance by $2,000.

- Given the enhanced scope of the stormwater management study, this item has been moved from the operating budget ($10,000) to the 5-Year Capital Investment Plan.

Documents from the meeting include:

Council approved the 5-Year Capital Investment Plan as presented and approved the 2023/24 Operating budget with a 1-cent decrease to the tax rates.