Budget 2024/2025

April 17, 2024

Media Release

The Town of Berwick approved the 2024-25 operating and capital budgets at a special Town Council meeting on April 15, 2024. The balanced budget was approved with a two cent decrease to the residential and commercial tax rates. Council sought community feedback through public information sessions and budget survey. The Town of Berwick’s Council is committed to being fiscally responsible with your tax dollars, while also balancing the needs of the community and maintaining the municipal service levels the Town of Berwick is known for.

- The new residential tax rate will be $1.558 per $100 of assessment value

- The commercial tax rate will be $3.870 per $100 of assessment value

The highlights of the Town of Berwick’s 2024-25 budget include:

- Year 1 of significant upgrades to the Wastewater Treatment Plant

- A new building, with washrooms, at Centennial Park

- A new Office Administrative Coordinator position

- Collaborative projects with the Berwick Volunteer Fire Department, including a new water storage tank and completion of a Portable Pumper Truck

As discussed by Council and Town Staff during the budgetary process, the many factors that impacted the 2024 budget include the following:

- Increased property assessment values from PVSC

- Community feedback

- Rising costs, and the impacts of inflation at all service levels

The approved budgets can be found here:

How did we get here?

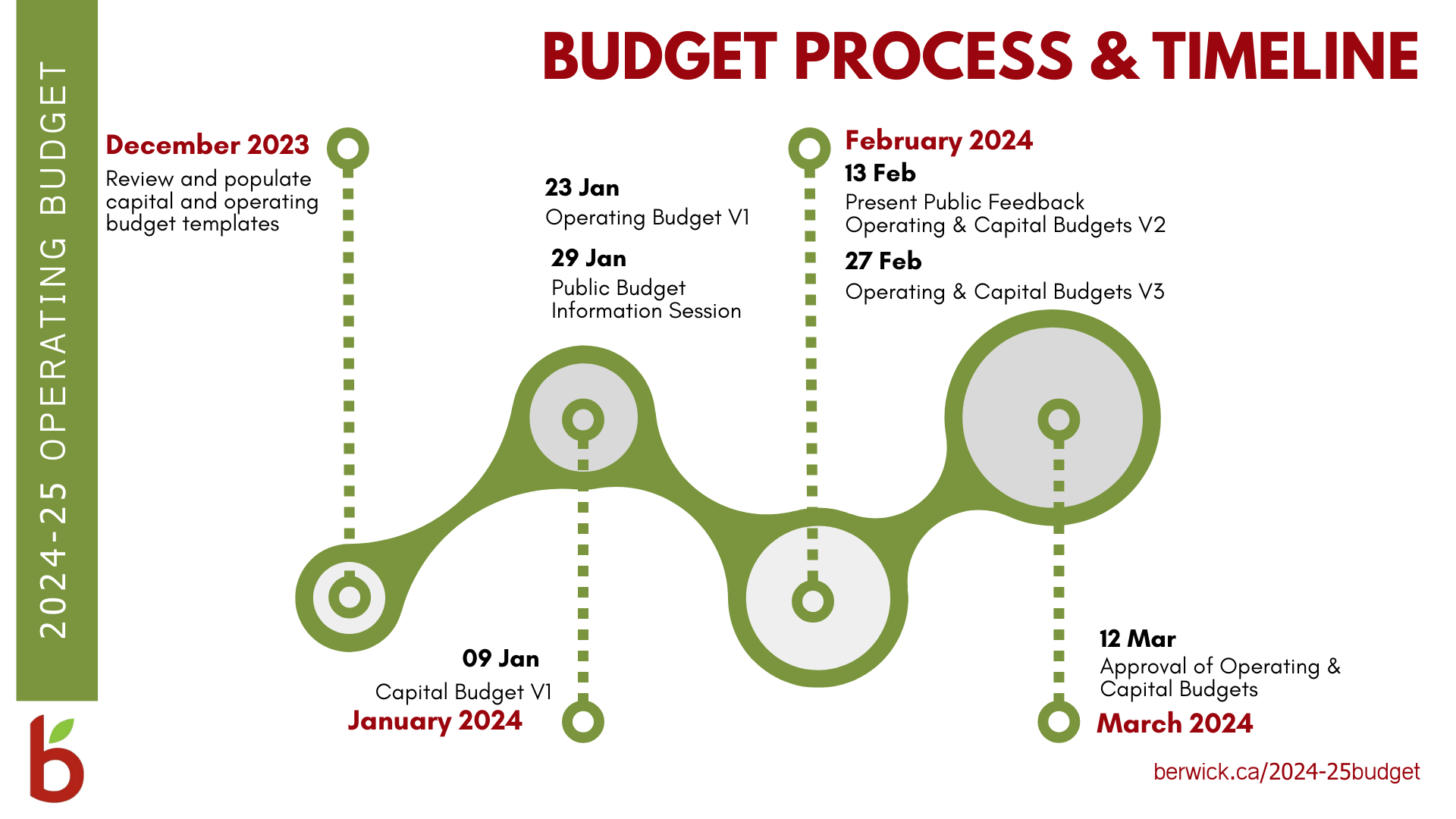

Berwick began the 2024-25 budget process in December 2023, working through preliminary budget information, and engaging all departments in the process, to best understand the needs and requirements of operations.

Every Committee of the Whole and Council meeting from January 9 to March 12 was an opportunity for Council to discuss, seek clarification, and provide direction to staff to move the operating and capital budgets forward for approval.

Until the budget was officially approved by Council, the highlights identified below were subject to change based on Council discussion, direction, and changes to assumptions.

As a reminder, property assessments are set by Property Services Corporation (PVSC). Please contact PVSC if you have any questions about your assessment. Notices were sent to property owners on January 8, 2024. The appeal deadline was February 8, 2024.

The 2024-25 Budget Process and Timeline is outlined below:

Tentative budget schedule:

Tentative budget schedule:

- January 9th, 2024- 1st Draft 5-Year Capital Investment Plan

- January 23rd, 2024-1st Draft Operating Budget

- RESCHEDULED January 29th, 2024 –Budget Public Information Session (BPIS) https://berwick.ca/budget-engagement-session.html

- February 13th, 2024- 2nd Draft Operating Budget/Capital budget and BPIS feedback; additional scenarios as directed by Council.

- February 20, 2024 - Budget Public Information Session (BPIS) https://berwick.ca/new-date-budget-engagement-session.html

- February 27th, 2024 -Final Draft Operating and Capital Budget to COTW

- March 12th, 2024- Approval of 2024/25 Operating & Capital Budgets

- March 18, 2024 - Special Council

- April 15, 2024 - Special Council

*All meetings were open to the public.

Use the links below to navigate to the relevant information.

-

January 09, 2024:

-

January 23, 2024

-

February 7, 2024

- Community Budget Survey is now OPEN https://www.surveymonkey.com/r/BerwickBudget

- Community Budget Survey is now OPEN https://www.surveymonkey.com/r/BerwickBudget

-

February 13, 2024

-

February 20, 2024

- Public Budget Engagement Presentation

- Public Budget Engagement Presentation

-

February 27, 2024

-

March 12, 2024

- April 15, 2024